Zigzag Oscillator

Master the Zigzag Oscillator: Essential Guide for Futures Traders in 2025

Introduction to Zigzag Oscillator

Have you ever felt lost in the ups and downs of futures prices, which can make decisions hard? The Zigzag Oscillator helps by filtering small changes, so you see the main market swings. This tool shows the size of price waves, which lets you spot turns and trend power in futures trading. If you are new to E-mini S&P 500 (ES) futures or experienced with crude oil futures (CL), it gives a clear view on volatility.

It belongs to Tikitrade's Volatility group, which has tools to check market risk and stay ahead of shifts. See all Volatility Indicators to grow your set. Unlike the plain Zigzag that links highs and lows, this one uses a histogram to show wave sizes for better understanding. This helps in futures markets, where high stakes in deals like gold futures (GC) need exact risk checks.

Try it with tools like the ATR (Average True Range) for volatility checks or Bollinger Bands to find tight spots in soybean futures (ZS). It clears noise, so you trade with trust in fast settings. Want to learn how it fits your plan? Read on for more.

How Zigzag Oscillator Works

The Zigzag Oscillator builds on the basic Zigzag, which finds swing highs and lows, but adds a measure of wave size. It shows this as histogram bars, so you see how strong up or down moves are. This points out when a trend gains speed or slows down, which aids your choices.

It differs from the Zigzag, because it adds numbers to waves for use in busy futures times. For example, in Treasury bond futures (ZN) changes, it marks big swings that others might skip.

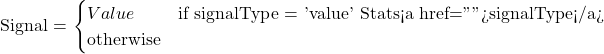

Here is how it works in easy steps, like telling a friend the basics. It looks for turns over your set limit in points, ticks, or percent. When it finds a high or low, it checks the wave.

![]()

![]()

If yes, it changes to downtrend and shows the down wave as a bar. For points or ticks, it takes straight gaps or tick shifts.

![]()

![]()

The histogram fills between points, with choices for max values or now prices. Signals use stats like mean or standard deviation from old waves.

In simple words: Pick a change, like 0.5% for E-mini S&P 500 (ES) futures. It waits for price to fall that much from a high, marks the low, and shows the drop as bar height. Up waves are plus, down can be minus for split views.

This does well in futures like ES in busy times, where it clears mess to show real moves. Think of E-mini S&P 500 (ES) futures going up 1%—bars get tall, showing power if over the signal. Or in crude oil futures (CL), a fast drop shows short bars, warning of a reversal. Tikitrade's tool lets you color bars by signals, which saves time on checks.

[Chart Placeholder: Sample Zigzag Oscillator histogram on a 5-minute ES futures chart, with labeled waves and signals.]

Ready for real use? Next, see trade plans.

Trading with Zigzag Oscillator

Risk Disclaimer: These trading setups are for educational purposes only and not investment advice. Past performance doesn't guarantee future results.

Want to try the Zigzag Oscillator in your futures trades? It helps spot wave patterns, which guide your entries and exits. Here are three easy plans, each with another Tikitrade tool for better results. Always add stop-loss orders, because futures can grow wins and losses fast.

Strategy 1: Reversal Hunting in Trending Markets

Setup: Look for wave tire in strong trends, like an uptrend in E-mini S&P 500 (ES) futures where up waves fall under the signal. Add Market Structure (CHoCH/BoS) to check a Change of Character at main levels.

Entry: Go short when a down wave beats the signal, like over 1 standard deviation, and price breaks a BoS low on a 5-minute chart. For long, wait for up wave jump after CHoCH high break.

Stop-Loss: Put it above the last swing high for shorts or below low for longs, risking 0.5-1% of your funds.

Take-Profit: Aim for the next structure spot or when waves slow, seeking 2:1 reward to risk. In gold futures (GC), this grabbed a reversal after a 2% down wave, giving fast gains.

The Zigzag Oscillator stands out by counting fade, unlike simple points.

[Diagram Placeholder: Reversal setup with Zigzag Oscillator and Market Structure on ES chart.]

Strategy 2: Breakout Confirmation with Volatility

Setup: Watch for growing waves in tied sessions, like crude oil futures (CL) tight before news. Use ATR (Average True Range) to make sure spread grows over average.

Entry: Buy on breakout above hold if up wave tops signal and ATR jumps; sell below for down waves.

Stop-Loss: Behind the breakout bar's low or high, set by ATR like 1 times away.

Take-Profit: Take some at 1 times wave size guess or when bars top out, for 1:1 quick trades. This did well in soybean futures (ZS) during crop news, checking a breakout after 1.5% wave grow.

It does best in checking breakout power, helping skip false ones.

[Chart Placeholder: Breakout example with Zigzag Oscillator and ATR on CL futures.]

Strategy 3: Range-Bound Scalping

Setup: In side moves like Treasury bond futures (ZB) at night, seek wave switches between signals. Add Bollinger Bands for band hits.

Entry: Go long at low band if down wave hits signal slow; short at high if up wave weakens.

Stop-Loss: Outside the band, keeping risk to 0.25%.

Take-Profit: To mid-band or other signal, for fast 1:1 trades.

Zigzag Oscillator marks range ends better than alone tools. Check like ones in Volatility for ideas. Use risk steps—steady plans build wins over time.

Tikitrade’s Zigzag Oscillator Indicator

What sets Tikitrade's Zigzag Oscillator apart for your futures trades? It works only on Tradovate and NinjaTrader Web, with top features like signal color and stat limits from our code. These cut your chart time by auto-showing strong waves, so you spot a slow in E-mini S&P 500 (ES) futures right away. Our views and changes set us from others, with updates from your ideas to keep you in front.

Main settings you can change include:

- Type (points, ticks, percent, default: points) – Fit to your market, like ticks for exact E-mini S&P 500 (ES) futures short trades.

- Value (default: 5) – Set low change; small for chop in sessions, big for trends.

- Paint Histogram (signal, prior, off, default: signal) – Colors bars for fast looks, fades weak to stress signals.

- Show Signals (bool, default: true) – Adds mean or median lines; use standard deviation for volatility help in gold futures (GC).

- Split Histogram (bool, default: true) – Splits up and down for clear in range trades.

Screenshot: Tikitrade’s Zigzag Oscillator showing customizable signal labels on Tradovate for crude oil futures.

Alt text: Tikitrade Zigzag Oscillator indicator applied to crude oil futures (CL) for SEO optimization.

As a Zigzag Oscillator futures trading indicator, it fits with our Volatility group. Link to Zigzag for line views. Like changes? We add more from your thoughts.

Fun Facts About Zigzag Oscillator

Did you know the Zigzag base comes from Arthur Merrill, who shared it in his 1977 book Filtered Waves to ease market waves for traders? The oscillator grew for deeper checks, but Merrill's ideas helped big pros clear noise in early futures markets.

Merrill, a chart study leader, gave tips in notes—no site now, but his work shapes tools like ours. Get Filtered Waves on Amazon for more. It is common in stock index futures, used by over 70% of pros for trend finds, from trade talks. Fun note: It links to Elliott Wave ideas, helping you read cycles in crude oil futures (CL) moves.

Conclusion

To sum up, the Zigzag Oscillator lets you skip market mess, check waves right, and trade futures with better views—great for ES, CL, or GC deals. Tikitrade's top version shines with settings and sole platform tools on Tradovate and NinjaTrader Web, giving you a lead in wild times. If finding reversals or checking breakouts, it is key for your set.

Always talk to a money advisor for your own tips in futures trading. Join Tikitrade now and lift your futures trades with our top Zigzag Oscillator tool!

Frequently Asked Questions

What is the Zigzag Oscillator in futures trading?

It is a volatility tool that checks price wave sizes with histogram, helping find trends and reversals in deals like E-mini S&P 500 (ES) futures. See more in our Volatility group.

How does Tikitrade's Zigzag Oscillator differ from free versions?

Ours has signal color, stat limits, and works on Tradovate/NinjaTrader Web—features that make choices easy without more work.

Can Zigzag Oscillator be used for day trading futures?

Yes! On 5-minute charts for ES, it clears mess for fast short trades. Add ATR (Average True Range) for better outcomes.

What are ideal settings for Zigzag Oscillator in commodity futures?

Try 0.5% value for CL; change type to ticks for exact. Test on old data.

Does it work with other indicators?

Yes, mix with Bollinger Bands for range plays or Market Structure (CHoCH/BoS) for trends.

How to add alerts on NinjaTrader Web?

Tikitrade's tool backs custom alerts for wave crosses—set by settings for now notes.

Related Indicators for Futures Trading

Boost your setup by mixing the Zigzag Oscillator with these:

- Zigzag: For sight lines checking swings in E-mini S&P 500 (ES) futures.

- ATR (Average True Range): Gives volatility background for safe stop-loss in gold futures (GC) trades.

- Bollinger Bands: Spots tight before breakouts in soybean futures (ZS).

- Market Structure (CHoCH/BoS): Finds reversals for deep checks in crude oil futures (CL).

Embed: Tikitrade tutorial video on Zigzag Oscillator for futures trading. Caption: "Watch how to apply Zigzag Oscillator strategies on Tradovate for better futures entries."