Session Gaps

Master Session Gaps: Essential Guide for Futures Traders in 2025

Introduction to Session Gaps

Session Gaps is a key indicator that shows price jumps between trading sessions, so you can find support and resistance areas in futures markets. It helps you see where price moved up or down at the start of a session compared to the last close, which often happens because of news after hours. You can use it when trading E-mini S&P 500 futures (ES) or crude oil futures (CL), because these markets have clear session breaks.

This indicator fits in Tikitrade's Support & Resistance category, which offers tools to manage risk and spot trends, so you link to the page for more options. Unlike MTF (Day/Week/Month) Gaps, which cover longer periods like days or weeks, Session Gaps focuses on specific sessions such as regular trading hours, giving you better detail for daily trades.

Why is it useful for you as a futures trader? In active markets like gold futures (GC) or soybean futures (ZS), these gaps can pull price back to fill them or show strong moves if they stay open. You can pair it with tools like Fair Value Gap (FVG) to check imbalances, or Session Volume Profile to see volume support. Ready to try this in your trades?

How Session Gaps Works

Session Gaps finds and draws price areas where trading skipped between sessions, so you get clear levels for decisions. It checks the close from one session against the open of the next, which marks a gap if they differ. The indicator then watches if price returns to that area, so it notes when the gap fills after a cross.

You can set it up easily, even if you are new to futures, because the steps are basic. First, pick your session, such as custom times from 9:30 AM to 4:00 PM ET for stock index futures, or use built-in options. The main idea uses these formulas to define the gap.

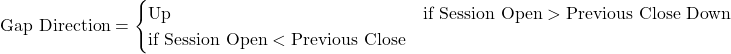

Before the formulas, know that gap direction tells if price opened higher or lower, which helps you see bullish or bearish starts.

The mid price gives a middle point for targets, so you calculate it as an average.

![]()

Extensions add levels outside the gap for more targets, which you set in points or percent.

*** QuickLaTeX cannot compile formula:

\text{Upper Extension} = \text{Previous Close} + \text{Value (points or % of gap size)}

*** Error message:

File ended while scanning use of \text@.

Emergency stop.

*** QuickLaTeX cannot compile formula:

\text{Lower Extension} = \text{Previous Close} - \text{Value (points or % of gap size)}

*** Error message:

File ended while scanning use of \text@.

Emergency stop.

For example, on Nasdaq 100 futures (NQ), if the prior regular trading hours (RTH) close is 18,000 and open is 18,100, you have a 100-point up gap. The mid is at 18,050, and a 50% extension adds levels like 18,150 up or 17,950 down.

Unlike Fair Value Gap (FVG), which looks at order imbalances, Session Gaps ties to session times, so it works well in futures like Treasury bonds (ZN) with global news gaps. In busy sessions, it spots reversals, such as ES gapping down on data then filling as buyers enter. Or on CL, an up gap from reports shows momentum.

Tikitrade adds custom clouds to shade gaps, which helps you see them fast on Tradovate or NinjaTrader Web. How can you use Session Gaps in your trades? It helps most in trending futures, alerting you to entries at these levels.

Chart: Example of Session Gaps on an ES futures chart, labeling open, close, mid, and extensions for a down gap.

Trading with Session Gaps

Risk Disclaimer: These trading setups are for educational purposes only and not investment advice. Past performance doesn't guarantee future results.

Want to start using Session Gaps? Here are three strategies for futures, mixed with other Tikitrade tools, so you can test them out. Always use risk rules, such as risking 1-2% of your account per trade, and practice on a demo first for better results.

Gap Fill Reversal Strategy

Setup: Look for a gap at session open on E-mini S&P 500 futures (ES), with RSI (Relative Strength Index) at overbought or oversold levels above 70 or below 30. The gap acts as support or resistance in a range market, so watch for holds.

Entry: Enter on a price turn at the gap edge, such as a bullish candle close above the mid in a down gap. Check RSI for divergence from price, which adds strength to the signal.

Stop-Loss: Set it below the gap low for buys or above the high for sells, around 10-20 ticks to handle swings.

Take-Profit: Aim for the other gap side or a 2:1 reward, like 100 points on a 50-point gap.

Session Gaps helps spot reversal areas here, especially with RSI for momentum changes in stock futures.

Gap and Go Breakout Strategy

Setup: Find a clear directional gap in commodity futures like gold (GC), matching Market Structure (CHoCH/BoS) with a breakout like higher highs after an up gap.

Entry: Buy or sell on a pullback to the gap open if it holds as support or resistance, with rising volume from Session CVD.

Stop-Loss: Place it just inside the gap, such as 0.5% below the open for buys, to guard against fake moves.

Take-Profit: Target indicator extensions, like the first upper one in an up gap, or trail with a 20-period EMA.

This setup uses Session Gaps for trend strength, so you can follow moves in active assets like GC.

Range-Bound Extension Fade Strategy

Setup: In slow sessions for farm futures like soybeans (ZS), note a small gap and use extensions as limits, checked with Bollinger Bands for tight ranges.

Entry: Fade at an extension hit with rejection, such as sell at upper if bands are narrow.

Stop-Loss: Put it past the extension by 1 ATR, which allows for small wicks.

Take-Profit: Go for the gap mid or full close, taking half profit at mid.

Session Gaps defines range edges well here, and Bollinger Bands add squeeze signals. Use stops always, because futures shift fast, and test for steady wins.

Diagram: Step-by-step setup for Gap Fill Reversal on a futures chart, with arrows for entry and stops.

Tikitrade’s Session Gaps Indicator

Try Tikitrade's premium Session Gaps tool, made just for Tradovate and NinjaTrader Web, so you get easy access. It stands out with color clouds to fill gap areas, which makes them stand out on full charts for fast looks in quick markets like NQ. It also has alerts for fills or breaks, and you can change core settings for session types, which cuts down on hand work.

We love adding updates from user ideas, such as showing old gaps for past views. Unlike free options, Tikitrade gives extras like cloud fade levels and label changes, so you set looks to fit your way and improve futures trades.

Here are key settings you can change:

- Session: Pick 'custom' or set ones like RTH, so it fits your ES day session for exact gaps.

- ShowExtensions (default 3, up to 5 or off): Draw added levels for goals, good for scaling in CL trades.

- ExtType (percent or points): Use gap size or fixed amounts, flexible for wild ZS charts.

- ShowCloud (default true): Turn on shaded spots for clear views, helping spot support and resistance.

- LabelSize and LabelColor: Change text for easy reads, with choices like level and price show.

Screenshot: Tikitrade’s Session Gaps with custom cloud and extensions on Tradovate for crude oil futures. Alt text: Tikitrade Session Gaps indicator on crude oil futures (CL) for SEO.

See more in our Support & Resistance group, or mix with Session OHLC Levels for more layers. Session Gaps futures trading indicator—give it a go on Tikitrade!

Fun Facts About Session Gaps

Ever think about where gap trading began? It has roots in markets from the 1920s, with early studies on U.S. stocks noting gaps in indexes like the DJI as far back as 1928. In futures, session gaps grew popular for catching moves after hours, mainly in stock indexes hit by world events.

A neat start: Gap ideas came from old chart work, where 1930s traders saw "windows" on candle charts, a Japanese method brought to the West. To learn more, read Technical Analysis of Gaps: Identifying Profitable Gaps for Trading by Julie R. Dahlquist and Richard J. Bauer Jr., which covers gap kinds and gains. Used a lot in futures for turns, Session Gaps lets you use this old edge—cool how a price skip can mean big chances!

Conclusion

Session Gaps helps you handle futures markets with ease, changing session jumps into support, resistance, and move signals. From fills in ES to breaks in GC, it works in many setups. Tikitrade's top version has custom clouds, extensions, and alerts, only on Tradovate and NinjaTrader Web—better than others.

If you are starting with first turns or tuning plans as an expert, this tool adds to your set. Check with a money advisor for your own tips in futures trades. Join Tikitrade now and lift your futures trades with our premium Session Gaps indicator!

Frequently Asked Questions

What are Session Gaps in futures trading?

Session Gaps show price jumps between set trade times, like RTH open vs. prior close. They help find fills or keeps in deals like NQ.

Can Session Gaps be used for day trading futures?

Yes, it fits day setups on Tradovate, finding turns in busy times. Mix with Supertrend for trend checks.

How does Tikitrade's Session Gaps differ from free versions?

Our top one has special clouds, up to 5 extensions, and custom labels—plus platform fits for NinjaTrader Web, better than basic ones.

Is Session Gaps good for commodity futures like CL?

It is, shining in wild goods by showing gaps after news, so you trade fills or extensions well.

How do I set up Session Gaps on my chart?

On Tikitrade, choose custom hours like 9:30-16:00 ET, turn on clouds and labels, then add to your ZB chart for quick looks.

Does Session Gaps work in ranging markets?

It does, setting bounds with extensions—great for fades in ZS during calm times.

Related Indicators for Futures Trading

- Mix Session Gaps with Fair Value Gap (FVG) to find skips in gold futures (GC) trades.

- Join with Session Volume Profile to check volume in crude oil futures (CL) gaps.

- Use next to Market Structure (CHoCH/BoS) for break signals in E-mini S&P 500 futures (ES).

- Link to Bollinger Bands for tight spots around gaps in soybean futures (ZS).

Embed: Tikitrade tutorial video on Session Gaps for futures trading. Caption: Learn Session Gaps strategies for ES and CL on Tradovate.