Icebergs

Master the Icebergs Indicator: Unlock Hidden Order Flow in Futures Trading

Introduction to Icebergs

Have you ever wondered how big players hide large trades in the futures market, so they avoid alerting others? The Icebergs indicator helps you spot these hidden orders, which are called iceberg orders. It shows potential large buys or sells that reveal only a small part at first. This tool predicts price reversals or continuations, which works well in futures like E-mini S&P 500 (ES) or crude oil (CL).

Icebergs belongs to the Order Flow category, which shows buying and selling inside chart bars to find market imbalances. Whether you are new or experienced in futures, this indicator helps you see trader actions clearly.

Compare Icebergs to Imbalance in futures trading, because Imbalance spots buy-sell mismatches at prices, while Icebergs focuses on hidden large orders at swing points. This gives you a deeper view for strategies in commodity futures like gold (GC). Pair it with Bar Volume Profile so you get a complete auction picture in equity index futures such as Nasdaq 100 (NQ). Ready to try this for your next trade?

[Placeholder for chart: Example of Icebergs indicator on an ES futures chart, with labeled hidden orders.]

How Icebergs Works

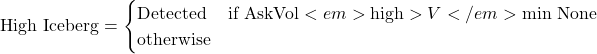

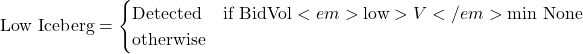

The futures market has large orders that traders hide, and this indicator spots them through volume profile analysis. Icebergs checks each bar's volume profile, which breaks down traded volume at every price level. It finds high ask or bid volumes at the bar's high and low points, so it signals hidden liquidity.

First, the indicator looks for swing highs and lows. A swing high happens when the prior bar's high is greater than the one before it and the current one, which suggests a possible top. A swing low occurs when the prior low is less than its neighbors, which indicates a bottom.

![]()

![]()

After finding a swing, Icebergs scans the volume profile for unusual volumes. It marks an iceberg if ask volume at the high exceeds a set minimum, like 100 contracts, because this shows sell-side hidden orders as resistance. For the low, high bid volume signals buy-side icebergs as support.

This process works best in high-volume futures sessions, such as during economic data releases that affect Treasury bonds (ZN). For example, in soybean futures (ZS) amid harvest news, a low iceberg might show strong buying, which holds prices steady despite sales. Compared to Sweeps, which follows bold order moves, Icebergs targets quiet hidden builds for subtle signals in rollovers.

A special Tikitrade feature is realtime plotting, which lets you see zones update live on your chart without delay on platforms like Tradovate. How do you use Icebergs in your trading? Watch these levels for price bounces in CL futures, such as when a buy iceberg appears at a dip and price rises to confirm support. Learn more about order flow basics at CME Group.

[Placeholder for diagram: Step-by-step illustration of swing detection and iceberg flagging on a volume profile chart.]

Trading with Icebergs

Risk Disclaimer: These trading setups are for educational purposes only and not investment advice. Past performance doesn't guarantee future results.

Ready to apply Icebergs in your futures trades? Here are three strategies for different market types, each using Icebergs with another Tikitrade tool. Always set stop-losses to limit risk to 1-2% of your account per trade, and test them first on a demo.

Reversal Strategy with RSI

Setup: Find an iceberg at a swing high or low when conditions are overbought or oversold on your chart. Use RSI (Relative Strength Index) to check exhaustion, such as in ES futures during a rise when RSI hits over 70.

Entry: Sell short when a candlestick closes below the iceberg level after a bearish pattern, like a shooting star appears.

Stop-Loss: Set it above the recent swing high, about 5-10 ticks away to handle small fluctuations.

Take-Profit: Aim for the next support level, such as a prior low or a 2:1 risk-reward setup. Icebergs helps here by showing hidden selling, which improves reversal chances in active equity futures.

Breakout Strategy with Supertrend

Setup: Watch icebergs near main levels in trending markets, like NQ futures moving up strongly. Add Supertrend for trend checks, and wait until it turns bullish.

Entry: Buy when price closes above a high iceberg, which means hidden sellers are overcome.

Stop-Loss: Place it below the iceberg or a recent low, around 1 ATR to give room.

Take-Profit: Exit at the next resistance or on Supertrend reversal, while trailing stops for larger gains. This approach uses Icebergs' liquidity spotting, which performs well in commodity breakouts like GC during world events.

Range-Bound Strategy with Market Structure

Setup: In flat markets, like CL futures in quiet hours, spot icebergs at range highs and lows. Pair with Market Structure (CHoCH/BoS) to see change of character signals close to these areas.

Entry: Sell at a high iceberg on a downward CHoCH rejection, or buy at a low one on an upward shift.

Stop-Loss: Put it outside the range end, maybe 8-12 ticks past the iceberg for safety.

Take-Profit: Target the opposite range side or a 1.5:1 ratio fixed. Icebergs shines in ranges by marking absorption spots, so you can fade extremes with confidence. Try similar tools like Unfinished Auction for more auction details.

These strategies highlight Icebergs' skill in revealing order flow secrets, but focus on risk management to safeguard your capital in futures trading.

[Placeholder for chart: Examples of the three strategies on sample futures charts with entry and exit points labeled.]

Tikitrade’s Icebergs Indicator

Tikitrade offers the Icebergs indicator only on Tradovate and NinjaTrader Web, with special features that stand out for futures traders like you. Unlike simple versions, our tool has colorful cloud views for zones, signals through symbols, and adjustable methods to match your needs. This saves you time by marking hidden orders without manual checks.

One key feature is coloring icebergs and symbols for up or down directions, which helps quick reads in fast ES sessions. Also, realtime mode stretches zones as they form, limited to your set number for clean charts in CL swings.

Here are main settings you can change for your futures trading:

- icebergVolumeMin (default 100) – Choose the volume limit to find big hidden orders, such as 200 for busy NQ futures.

- showIcebergLevels (default true) – Turn on horizontal zones to see support and resistance, which extend for better trend views in ZB bonds.

- showIcebergSignal (default 'caret') – Pick symbols for alerts at swings, with shifts for neat chart spots.

- realtimeIcebergLimit (default 20) – Limit shown zones in live trades to keep focus on new action without clutter.

- icebergOpacity (default 100) – Change see-through level for soft overlays that mix well with other indicators.

Screenshot: Tikitrade’s Icebergs showing customizable zones and signals on Tradovate for crude oil futures. Alt text: Tikitrade Icebergs futures trading indicator applied to crude oil futures (CL) for SEO optimization.

Part of our Order Flow group, this Icebergs futures trading indicator works well with items like Exhaustion. We love adding updates from your ideas—give it a try to improve your choices today!

[Placeholder for diagram: Customizable parameters panel in Tikitrade’s Icebergs on a sample chart.]

Fun Facts About Icebergs

Did you know iceberg orders started in the late 1990s, when algorithmic traders used them to hide big moves in electronic markets? The name comes from real icebergs, where most mass hides below water, so institutions avoid price changes in futures like those at CME Group.

No one person created them, but they grew popular with high-speed trading, especially in equity index futures where funds mask positions to stop others from copying. In your trading, finding them through order flow feels like solving a puzzle, and they are common in commodity futures for quiet builds during trends. Want more? Look at algorithmic strategy resources to build your skills.

Conclusion

To sum up, the Icebergs indicator helps you find hidden market forces in futures trading, from reversals in ES to breakouts in GC. It focuses on order flow imbalances for real help, especially with Tikitrade's custom features like realtime zones and colored signals on Tradovate or NinjaTrader Web. We believe our tools offer you the best chance for steady results, always with good risk steps.

Always talk to a financial advisor for advice tailored to your futures trading. Sign up for Tikitrade today and improve your futures trading with our premium Icebergs indicator!

Frequently Asked Questions

What are iceberg orders in futures trading?

They are large orders split into small visible parts to reduce impact, common in futures to hide plans. Tikitrade's Icebergs finds them using volume profiles.

Can Icebergs be used for day trading futures?

Yes, it fits intraday plans in contracts like NQ, finding hidden liquidity during the day. Change settings like icebergVolumeMin for short frames.

How does Tikitrade's Icebergs differ from free versions?

Our premium has special changes, like paintSymbols for direction colors and realtime limits, plus easy fit on Tradovate—not in basic ones.

What futures markets work best with Icebergs?

It does well in high-volume types like ES, CL, or ZS, where order flow shows big moves. Pair with Session Volume Profile for day-specific views.

How to set up Icebergs on NinjaTrader Web?

Add it through Tikitrade, adjust items like symbolSize for clear views, and put it on your chart—simple for starters.

Does Icebergs provide alerts?

Yes, with visual signals; add platform alerts for notes on new icebergs in your trades.

Related Indicators for Futures Trading

Improve your Icebergs plans with these matching tools:

- Imbalance: Finds buy-sell gaps to back Icebergs' hidden orders in CL futures for better reversals.

- Sweeps: Follows strong fills with Icebergs for speed plays in NQ.

- Exhaustion: Shows low volume at Icebergs levels, good for range trades in GC.

- Bar Delta Profile: Adds delta details to Icebergs' volumes for exact entries in ES.

Embed: Tikitrade tutorial video on Icebergs for futures trading. Caption: Learn Icebergs settings for futures contracts like ES and CL.