On Balance Volume (OBV)

On Balance Volume (OBV) Explained: Unlock Its Power for Futures Markets

Introduction to On Balance Volume (OBV)

Whether you are new to futures contracts or have years of experience, the On Balance Volume (OBV) indicator can help you a lot. This tool follows the flow of trading volume as prices change, so you spot shifts in buying or selling pressure early. In futures trading, where markets like E-mini S&P 500 (ES) or crude oil (CL) move fast on news, OBV shows hidden market strength.

OBV belongs to the Volume category, which looks at how much activity supports price moves. Explore all Volume Indicators to find tools that fit your needs. How does OBV differ from Accumulation/Distribution (A/D)? A/D weighs volume by price range in each bar, while OBV uses simple totals, which makes it faster for trends in busy futures like Nasdaq 100 (NQ).

Try pairing OBV with RSI (Relative Strength Index) for momentum checks, or Supertrend for trend signals, and build a strong setup. OBV works well in high-volume sessions, such as during CME Group contract rollovers, because it helps avoid false moves. Ready to use this in your trades? Tikitrade's premium OBV offers custom resets and visuals, only on Tradovate and NinjaTrader Web.

How On Balance Volume (OBV) Works

Why do some price jumps in futures fade while others keep going? On Balance Volume (OBV) links trading volume to price direction, which acts as a gauge for market interest. In short, it adds volume on up days and subtracts on down days, so you get a running total that often moves before prices. For futures traders, this means finding buildup in soybean futures (ZS) during harvest time or sell-off in gold futures (GC) during economic shifts.

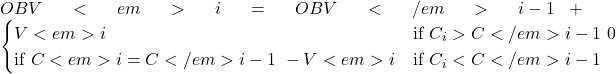

Let us go through the calculation step by step, as if we are talking it over. You begin with an initial OBV value, which is often zero on a new chart. For each bar, compare the current close to the previous one, then adjust by the volume.

In this formula, (OBVi) is the current OBV, and (OBV{i-1}) is the last one. (Vi) is the current volume, while (C_i) and (C{i-1}) are the current and previous closes. If today's close is higher, add today's volume because buyers lead. If lower, subtract it since sellers control. If equal, do nothing as pressure stays the same.

This total line rises with steady buying and falls with selling. In futures, look for divergences: Prices reach new highs in ES futures, but OBV stays flat? That warns of weaker momentum, ideal for busy sessions where Treasury bonds (ZN) respond to Fed updates. Unlike Money Flow Index (MFI), which includes typical prices, OBV focuses on volume alone, so it cuts noise for day trades.

Tikitrade adds reset options, which let you start OBV fresh each day for clear sessions on Tradovate. Picture NQ futures in a tech rise: OBV climbs steadily, which confirms the uptrend. During a rollover drop, falling OBV signals care. Or think of CL futures after OPEC news—rising volume lifts OBV, which points to breakouts. These show how to use On Balance Volume (OBV) in futures trading: It does best in trends but watch flat spots in ranges. For more on volume, see CME Group guides.

Chart: Example of OBV line showing divergence on an ES futures chart.

Trading with On Balance Volume (OBV)

Risk Disclaimer: These trading setups are for educational purposes only and not investment advice. Past performance doesn't guarantee future results.

Ready to try OBV in your futures trades? Here are three strategies for markets like stock indices or goods. Always set stop-losses to control risk—aim for 1-2% of your account each time—and test them on a demo via NinjaTrader Web.

Strategy 1: Trend Confirmation with EMA Crossover

Setup: Watch OBV rise as price holds above a Exponential (EMA), like a 50-period on a 15-min ES chart. This shows growing buy pressure in S&P 500 futures during up phases.

Entry: Go long when price crosses the EMA and OBV hits a new high, which confirms volume support.

Stop-Loss: Set below the recent swing low or EMA, about 10-20 ticks away to handle swings.

Take-Profit: Aim for 2-3 times your risk, or exit on OBV divergence like a flat line as price rises. OBV shines in confirming trends, unlike price tools that skip volume hints.

Strategy 2: Divergence Reversal with RSI

Setup: Find bearish divergence in gold futures (GC)—price makes higher highs on a 5-min chart, but OBV shows lower highs. This hints at fading up moves during inflation news.

Entry: Short when price breaks support level and RSI (Relative Strength Index) falls below 70, with OBV backing the drop.

Stop-Loss: Place above the recent high, which guards against false drops.

Take-Profit: Target the next support or when OBV levels out. This works well for reversals, where OBV's volume view beats oscillators alone in rough goods swings.

Strategy 3: Breakout Boost with Supertrend

Setup: In crude oil futures (CL), see OBV climb fast in a range near resistance level, with Supertrend turning bullish.

Entry: Buy on a candlestick close above resistance if OBV jumps, which shows strong volume breakout.

Stop-Loss: Set below the breakout bar's low, keeping it close for energy market ups and downs.

Take-Profit: Sell part at 1:2 risk-reward or follow with Supertrend. OBV filters weak moves in breakouts, so you ride trends in farm futures like ZS on supply news.

These highlight OBV's skill in volume confirmations. Check similar tools in the Volume category for more pairs. Remember, steady risk steps turn setups into wins.

Diagram: Labeled setup for divergence reversal strategy on a GC chart.

Tikitrade’s On Balance Volume (OBV) Indicator

Tikitrade's premium On Balance Volume (OBV) for futures trading lifts the basic tool with special features made for traders like you. Unlike plain versions, ours works smoothly on Tradovate and NinjaTrader Web, which saves time with color clouds for trends and signals for fast choices. Spot a divergence in NQ futures right away—our clouds mark up/down pressures in green/red, so you act quicker in busy markets.

What makes us different? We include reset choices, so you restart OBV daily, weekly, or at set times, perfect for session trades in ES futures. Add an average line like EMA on OBV for smooth signals, and color bars by OBV versus zero or average—visual helps that boost your lead without mess.

Here are main settings you can change for your way:

- Price Source (default close) – Pick open, high, low, or close to fit calculations, good for swingy goods futures like CL.

- Reset Frequency (default never) – Choose daily or intraday for new starts, which clears buildup noise in bond futures (ZB).

- Average Period (default 13) – Smooth OBV with a moving average, which helps find crossovers in trend markets.

- Show Cloud (default true) – Turn on clouds with opacity set, which builds trust in reversals.

- Show Signals (default zero crossover) – Get alerts for zero or average crosses, which speed entries on NinjaTrader Web.

Screenshot: Tikitrade’s On Balance Volume (OBV) showing customizable clouds and signals on Tradovate for crude oil futures.

Alt text: Tikitrade On Balance Volume (OBV) indicator applied to crude oil futures (CL) for SEO optimization.

We love updates from your ideas—give it a try and see why Tikitrade tops futures tools. Explore all Volume Indicators for more.

Fun Facts About On Balance Volume (OBV)

Did you know OBV started in the 1960s? Joseph Granville made it in 1963, and it first showed in his book Granville's New Key to Stock Market Profits, which aimed to show volume's role in price guesses. Granville, a bold analyst with big calls, viewed OBV as a key to market hints.

Though he passed in 2013 without a main site, his thoughts stay in futures trading, where OBV tracks big flows in indices like ES. Some pros use it for smart money views, spotting builds in farm futures (ZS) before reports. It gains fans because volume often leads price, which gives you an early step in swingy sessions.

Conclusion

To sum up, On Balance Volume (OBV) serves as a strong tool for futures traders, which shows volume trends and divergences in markets from ES to GC. Its basic total method, boosted by Tikitrade's resets, clouds, and signals, gives you a sharp lead in choices. Whether checking breakouts or finding reversals, OBV lifts your trust on Tradovate and NinjaTrader Web.

Always talk to a money advisor for advice fit to you in futures trading. Sign up for Tikitrade today and lift your futures trading with our premium On Balance Volume (OBV) indicator!

Frequently Asked Questions

What is On Balance Volume (OBV) in futures trading?

OBV tracks total volume by price direction, which helps find buy/sell pressure in contracts like NQ. It aids trend checks.

Can On Balance Volume (OBV) be used for day trading futures?

Yes—on short frames like 5-min for ES, it spots day shifts. Pair with Supertrend for better outcomes.

How does Tikitrade's On Balance Volume (OBV) differ from free versions?

Our premium adds resets, averages, clouds, and signals, only on Tradovate and NinjaTrader Web, for clear views and alerts.

What are ideal On Balance Volume (OBV) settings for futures?

Begin with average period 13 and daily resets for sessions. Change for your market, like longer for GC trends.

Does OBV work with other indicators?

Yes, mix with RSI (Relative Strength Index) for divergences or Bollinger Bands for squeeze in CL.

Is OBV effective in low-volume futures markets?

It works best in high-volume like indices, but use care in thin ones—add filters like min volume levels.

Related Indicators for Futures Trading

Boost your OBV with these from Tikitrade:

- Accumulation/Distribution (A/D) – Adds to OBV by weighing volume in bars for better pressure reads in soybean futures (ZS).

- Money Flow Index (MFI) – Brings overbought/oversold to OBV trends, good for gold futures (GC) reversals.

- Volume Oscillator – Finds short volume jumps with OBV for breakout checks in crude oil (CL).

- Chaikin Money Flow (CMF) – Pairs with OBV for buildup views in Treasury bonds (ZN).

Embed: Tikitrade tutorial video on On Balance Volume (OBV) for futures trading. Caption: Learn OBV strategies for ES and CL on Tradovate.