Fractal Harmonics

Master Fractal Harmonics: Essential Guide for Futures Traders in 2025

Introduction to Fractal Harmonics

Whether you are new to futures trading or experienced, the Fractal Harmonics indicator helps you measure market waves and spot potential reversals. This tool finds fractal patterns, which are repeating highs and lows that show changes in price momentum, so you can track rotations between them.

Fractal Harmonics belongs to the Volatility category, where indicators assess market risk and support decisions in changing conditions. Unlike basic tools like ATR (Average True Range), which tracks average price swings, Fractal Harmonics shows wave sizes in a histogram format, which makes it easier to compare current moves to past ones. This provides an advantage in futures markets, where fast insights can improve trades on E-mini S&P 500 futures (ES) or crude oil futures (CL).

We built this indicator based on ideas from Morad Askar, known as FuturesTrader71, so we give him credit for his work on fractals and rotations. Check out his insights in this YouTube webinar on high-volatility trading, where he explains measuring rotations for better risk management. For futures traders, it works well in equity index futures like Nasdaq 100 (NQ) or commodity trades like gold futures (GC), where extended waves can signal entries or exits.

Pair it with tools like Williams Fractals to find key levels or Fractal Zigzag to follow trends more clearly. Ready to use this for your futures strategies? Let's see how Fractal Harmonics can help you on platforms like Tradovate or NinjaTrader Web.

Chart: Example of Fractal Harmonics on a price chart, showing up and down waves with histogram bars.

How Fractal Harmonics Works

Fractal Harmonics breaks down price action into waves using fractal points, which helps you measure volatility in futures contracts. The indicator detects fractals, which are local highs or lows confirmed by nearby bars. Unlike the basic Zigzag that connects extremes after the fact, Fractal Harmonics creates a real-time histogram of wave sizes, colors bars based on strength, and adds signal lines from averages. This makes it useful for futures trading, where busy sessions or contract changes can increase swings.

Here is the calculation explained step by step, so you can follow it easily. First, the tool finds potential fractals.

A high fractal forms when a bar's high is the maximum over a window, which is set by barRange with a default of 2, checked against 2 bars before.

![]()

It confirms after barRange bars show lower highs, so the fractal is set.

![]()

Low fractals follow the same steps but for minimum values.

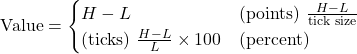

Once confirmed, the wave measures the distance from the last fractal low to high for an up wave or high to low for a down wave. The value shows in points, ticks, or percent.

For an up wave:

Here, H is the wave's high from the extreme or per bar, and L is the starting fractal low.

The histogram plots this for each bar in the wave, which can split positive for up and negative for down. It colors bars based on checks, like if the value exceeds a signal or the prior bar's value.

Signals come from stats on past waves, such as mean, median, mode, or standard deviations from 1 to 3. For example, an up wave signal might be the average up move.

![]()

This filters weak moves. In futures, it helps during active Globex sessions, alerting you if a soybean futures (ZS) wave goes beyond norms, which suggests exhaustion.

Consider NQ futures in a rally, where Fractal Harmonics shows growing green bars, so if they drop below the signal line, it might indicate a pullback. Or in Treasury bond futures (ZN), a down wave histogram going deep could signal oversold levels near rollover. Tikitrade's version adds custom colors and labels, which saves time on Tradovate as a special feature for futures analysis. Learn more about futures basics at CME Group.

Diagram: Step-by-step illustration of fractal confirmation and wave measurement on a bar chart.

Trading with Fractal Harmonics

Risk Disclaimer: These trading setups are for educational purposes only and not investment advice. Past performance doesn't guarantee future results.

Fractal Harmonics helps spot wave extensions in futures, which makes it good for reversal, breakout, and range strategies. Always use stop-losses to manage risk, aiming for 1-2% per trade, and test on a demo account. Pair it with tools like Market Structure (CHoCH/BoS) for context or Volume Delta to confirm momentum.

Strategy 1: Wave Reversal Trade

This targets overextended waves.

- Setup: Look for a completed wave where the histogram exceeds the signal line, such as 2 std dev, on a 5-min ES chart during regular hours. Confirm with Market Structure (CHoCH/BoS) showing a change of character.

- Entry: Enter short for up wave peak or long for down wave trough on a candlestick close beyond the fractal level, with rising volume delta.

- Stop-Loss: Place above or below the fractal high or low by 1-2 ATR for buffer.

- Take-Profit: Target the signal line value or prior wave's 50% retracement, and scale out half at 1:1 risk-reward.

In gold futures (GC), if an up wave stretches 3% beyond median, this setup catches reversals during news events.

Strategy 2: Breakout Continuation

Use this for trending markets.

- Setup: Find a fresh fractal confirming a wave direction on CL futures, where histogram colors strong without fading. Add Volume Delta for buying or selling pressure.

- Entry: Buy or sell on breakout above or below the fractal, with wave value above signal.

- Stop-Loss: Set behind the starting fractal by half the average true range.

- Take-Profit: Aim for next rotation size, such as mean plus std, or trail with a moving average.

This works in trending commodity futures like ZS during harvest reports, extending moves well.

Strategy 3: Range-Bound Scalp

Use this in sideways markets.

- Setup: In low-vol ZB futures, spot waves near zero line, with labels showing small percentages. Check with Market Structure (CHoCH/BoS) for no break of structure.

- Entry: Fade extremes when histogram fades and volume delta diverges.

- Stop-Loss: Place outside the range high or low.

- Take-Profit: Target mid-range or opposite signal line.

Fractal Harmonics helps here by measuring normal rotations, which avoids false breaks. Remember to use risk management for consistent results, and explore similar volatility tools for more ideas.

Chart: Example setups for reversal, breakout, and range trades using Fractal Harmonics on futures charts.

Tikitrade’s Fractal Harmonics Indicator

Tikitrade makes Fractal Harmonics easy to use with premium features for futures traders on Tradovate and NinjaTrader Web. Unlike basic versions, ours includes colorful cloud views for wave strength, trading signals for alerts, and options to change algorithms, which saves you time on analysis. For example, switch between points, ticks, or percent to fit your contract, like ticks for ES scalps.

What makes us different? Our support for these platforms means easy setup, plus updates from user feedback. We are excited about futures and add features our customers want.

Key customizable parameters include:

- Bar Range (default 2) – Change fractal sensitivity, tighten for busy NQ sessions or loosen for trending CL.

- Value Type (points/ticks/percent) – Fit to your style, such as percent for relative moves in GC.

- Signal Type (mean/median/mode/std/std2/std3) – Pick stats for signals, like std for volatility in ZN.

- Paint Histogram (signal/prior/off) – Highlight strong bars for fast decisions.

- Split Histogram (true/false) – Separate up and down for clear views in mixed markets.

Screenshot: Tikitrade’s Fractal Harmonics showing customizable signal lines on NinjaTrader Web for E-mini S&P futures (ES). Alt text: Tikitrade Fractal Harmonics futures trading indicator applied to E-mini S&P futures (ES) for SEO optimization.

As part of our Volatility suite, it works with Bar Size for deeper insights. Try Tikitrade’s Fractal Harmonics on Tradovate for your next futures trade!

Fun Facts About Fractal Harmonics

Did you know? Fractal Harmonics comes from ideas by Morad Askar (FuturesTrader71), a futures trading expert who shared harmonic rotations—average market swings via fractals—to help traders handle volatility. Since the early 2010s, he has taught these in webinars, focusing on how they show a market's unique traits for each futures contract.

Morad's work, including his book "The Orderflow Blueprint" (available on Amazon), covers practical futures strategies. Visit his site at futurestrader71.com for more. Used often in equity index futures for extended moves, this idea has aided many traders in choppy sessions.

Conclusion

Fractal Harmonics helps you measure market waves with accuracy, turning volatility into chances in futures trading. From finding reversals in ES to breakout trades in CL, its stats-based method, from experts like Morad Askar, gives a strong advantage. Tikitrade's premium version offers custom alerts and views on Tradovate and NinjaTrader Web, making analysis simple.

Improve your trading—sign up for Tikitrade today and use Fractal Harmonics for better futures trades! Always talk to a financial advisor for advice on futures trading.

Frequently Asked Questions

What is the Fractal Harmonics calculation in futures trading?

It finds fractals (confirmed highs/lows) and measures waves between them in points, ticks, or percent, with histograms and statistical signals for comparison.

Can Fractal Harmonics be used for day trading futures?

Yes—it fits intraday on 5-min charts, like spotting extensions in NQ during cash open. Change barRange for your timeframe.

How does Tikitrade's Fractal Harmonics differ from free versions?

Ours provides premium options like signal types (e.g., std dev) and alerts on Tradovate, plus cloud views not in others.

What are the best Fractal Harmonics settings for futures?

Begin with barRange=2, value=percent for relative views, signalType=std for volatility filters. Test on GC or ZS demos.

Does Fractal Harmonics work with other indicators?

Yes—use with Volume Delta for confirmation or Supertrend for trends.

How to set up Fractal Harmonics alerts on NinjaTrader Web?

In Tikitrade, turn on showSignals and labels; set notices for waves over thresholds, good for mobile futures checks.

Related Indicators for Futures Trading

- Fractal Zigzag: Follows wave paths for clear trend lines, working with Harmonics in CL trades.

- ATR (Average True Range): Adds raw volatility context for ZB setups.

- Zigzag Oscillator: Improves wave measurement for overbought signals in NQ.

- Range Filter: Removes noise, pairing well for clean harmonic reads in GC.

Embed: Tikitrade tutorial video on Fractal Harmonics for futures trading. Caption: "Watch how to apply Fractal Harmonics to ES futures for better entries."